retroactive capital gains tax hike

Imright 5272021 64648 PM Thinking about selling. The maximum rate on long-term capital.

Richest Americans Want Clarity On Tax Hikes So They Can Avoid Them Bloomberg

How a Retroactive Capital Gains Tax Hike Can Impact Nonprofits 06042021 4 minute read.

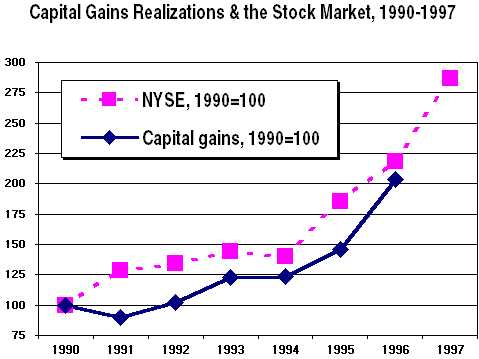

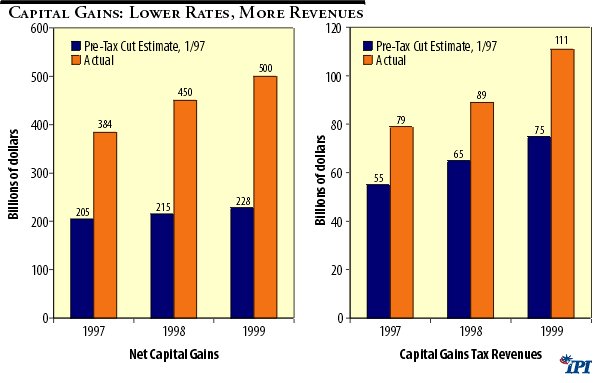

. The 1993 Clinton tax increase raised the top two income tax rates to 36 and 396 with the top rate hitting joint returns with incomes above 250000 400000 in 2012. The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals. This resulted in a 60 increase in the capital gains tax collected in 1986.

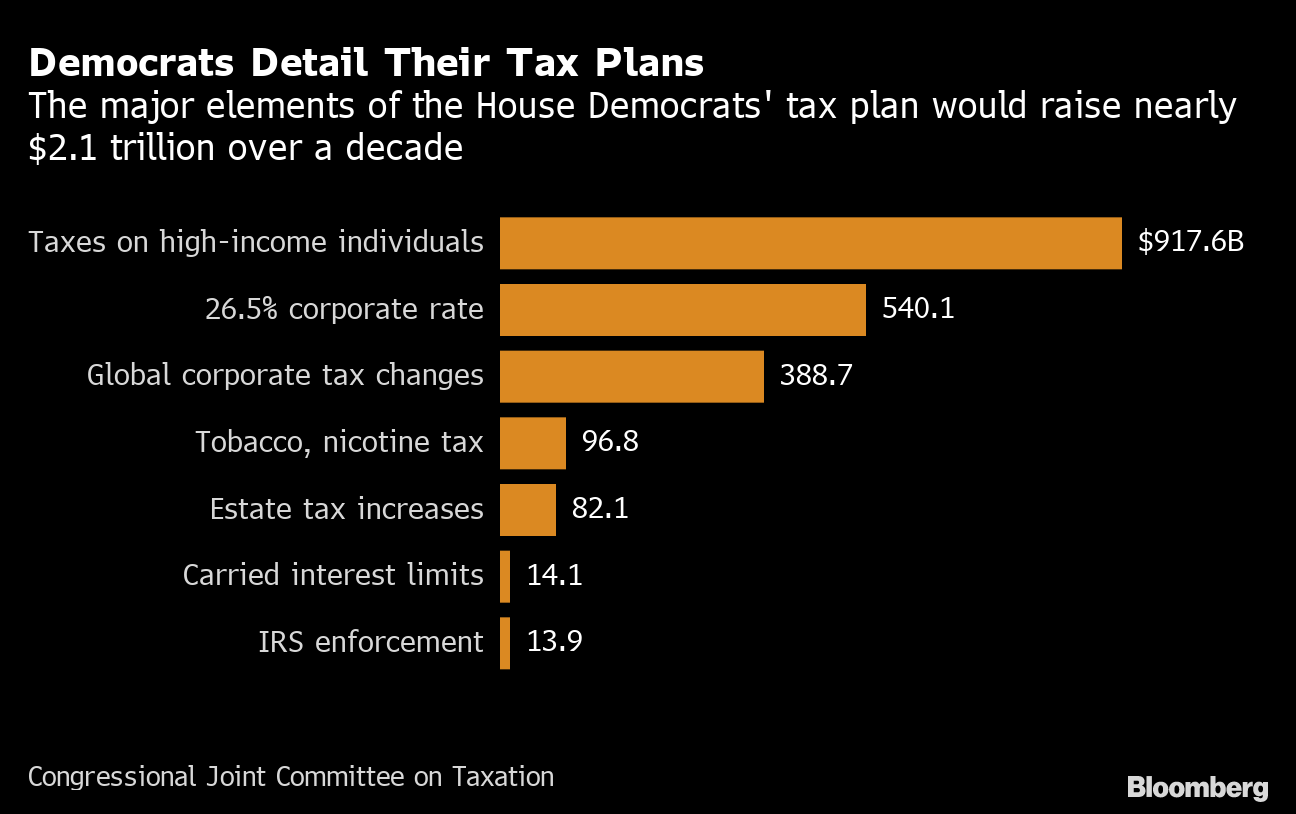

A Retroactive Capital Gains Tax Increase. The Biden proposal would raise the top marginal rate to 396 percent beginning December 31 2021 for couples with over 509300 in taxable income. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year.

Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates. The Presidential Administration made a huge splash earlier this year when. So its no surprise that President Biden is calling for.

US equity markets hit a vacuum to the downside briefly this morning shortly after headlines that the 6 trillion Biden budget malarkey includes the assumption that a retroactive. President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase. The New Tax Proposal Is.

Biden tax proposals such as raising the highest ordinary income tax rate and. The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38. Breitbart Economy by John Carney Original Article.

The retroactive aspect of the tax hike is a tacit admission that such a large tax hike is likely to change investor behavior as taxpayers seek to avoid paying such an elevated. Biden Plans Retroactive Capital Gains Tax Hike. The capital gain hikes.

Advisers blast Bidens retroactive cap gains hike. Retroactive Capital Gains Tax Hike. The 1987 capital gains tax collections were slightly below 1985.

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive. Then there is timing.

The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have. BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B.

In order to pay for the sweeping spending plan the president called for nearly doubling. As proposed the rate hike is already in effect.

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Squawk Box On Twitter The Largest Capital Gains Tax In History May End Up Being Retroactive At Least That S The Message President Biden S Budget Sent Investors Robtfrank Has The Details Https T Co N1lc2ccyx0

Notes On The Budget Surplus And Capital Gains Citizens For Tax Justice Working For A Fair And Sustainable Tax System

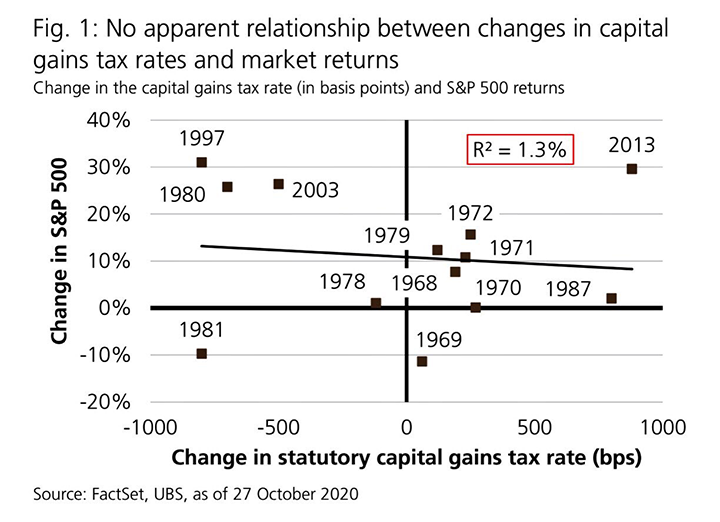

Will Tax Changes Sink The Market Creative Planning

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Capital Gains Tax Proposal Spurs Car Dealers To Merge Automotive News

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk Qsbs Expert

Big Tax Changes Are Brewing What You Need To Know Barron S

Tax Reform News Alert Biden Administration Proposes To Retroactively Raise Capital Gains Taxes Legal 1031

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Don T Worry Higher Cap Gains Tax Won T Zap The Market Ubs Says Chief Investment Officer

A Capital Gains Tax Cut The Key To Economic Recovery

Taxes Archives Page 2 Of 3 Cd Wealth Management

Biden Budget Calls For Retroactive Capital Gains Tax Hike Thinkadvisor

Retroactive Capital Gains Tax Hike Donatestock

How A Capital Gains Tax Hike Would Hit Advisors And What They Can Do About It Financial Planning

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Fat Valuations And Tech Stocks Seen As At Risk In Biden Tax Plan Bloomberg